Are you thinking of entering the Japanese market? You’ve come to the right place. You might be wondering where to start. Japan is a unique country with a business landscape full of complexities, but don’t worry. I’ll break down what you need to know about Japan market entry strategy in detail.

I’ll explain why you should consider entering the Japanese market, the common pitfalls to avoid, the cultural aspects you need to understand for a smoother market entry, as well as localization and marketing strategies. We’ll also cover investment models and scaling strategies.

Let’s dive in.

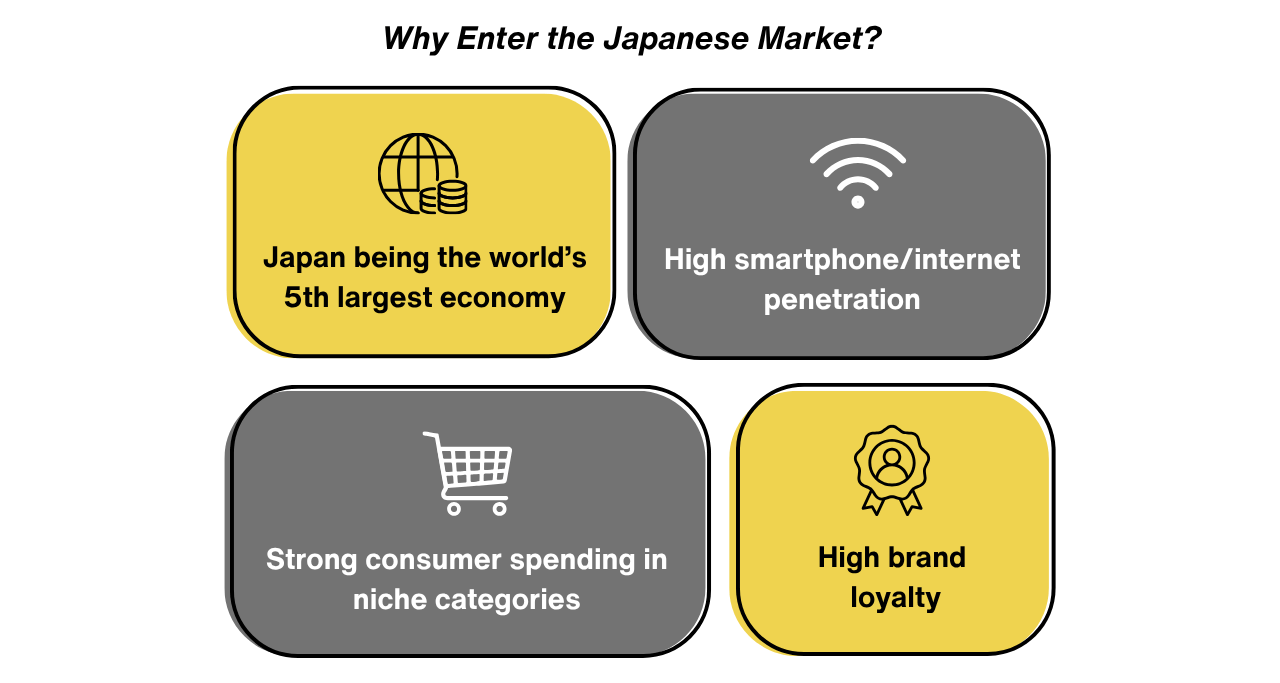

1. Why enter the Japanese market?

Japan is a lucrative market for several reasons, the first being its economy. Japan remains one of the strongest economic powers in the world, offering plenty of business opportunities. With a population that generally enjoys a high standard of living, many consumers have disposable income. Of course, this doesn’t mean everyone is ready to spend freely, but if you look at how certain groups invest heavily in their hobbies, such as collectibles, manga, anime, or J-pop, it’s a clear indicator that there are segments willing to spend on what they value.

The upside of Japan’s closed nature

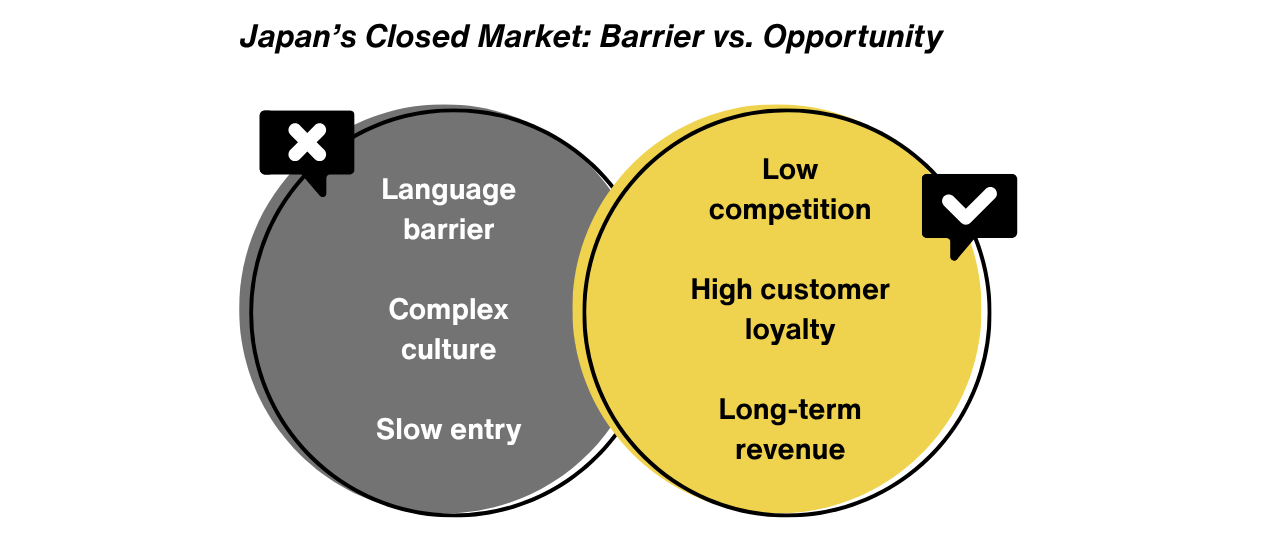

At the same time, it’s important to note Japan’s relative seclusion. As an island nation, Japan has developed a unique environment over centuries. While we’re not isolated from the world, this geography has shaped a culture where many things are uniquely Japanese.

The language is one of the biggest barriers. Japanese is the dominant language, and while there are many dialects, only a small percentage of the population is fluent in English. This means that most Japanese consumers, and businesses naturally, primarily engage with products and services available in Japanese. For foreign companies, this presents both a challenge and an opportunity: once you overcome the language barrier, you’ll likely face less competition because it’s not easy for your competitors to follow you into the Japanese market.

Personally, I see growing opportunities in IT, e-commerce, and SaaS. Part of this perspective comes from working with clients in these industries, but it’s undeniable that these sectors are expanding as more businesses and consumers become open to global solutions. This growing interest makes Japan a promising market for international businesses looking to enter and succeed.

2. Common challenges of Japan market entry

As described above, we need to acknowledge that language is a major barrier when entering the Japanese market. Cultural uniqueness adds another layer of complexity.

Japan’s unique cultural landscape

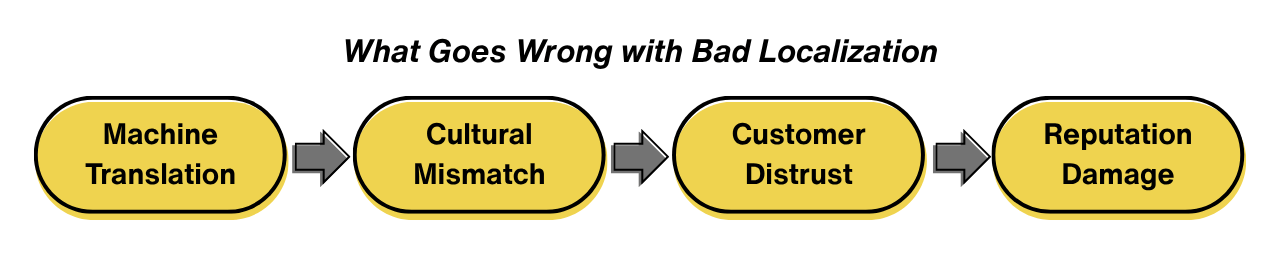

I’ve seen countless cases where companies believed that quick machine or AI translation would give them good exposure, only to end in miserable failure.

To make matters worse, failing in one country doesn’t mean your overall business reputation is unaffected. Your company is a unified entity, and issues in one region can impact your global brand. That’s why, when considering entry into the Japanese market, you should be equipped with the right knowledge.

We should also talk about Japan’s conservativeness. Personally, I’m open-minded and love traveling, but not everyone in Japan shares that mindset. As noted above, online communities tend to be more open (which is great news), but many traditional and larger corporations in Japan remain quite conservative. I often act as a middleman, managing communication and negotiation between Japanese corporations and international businesses.

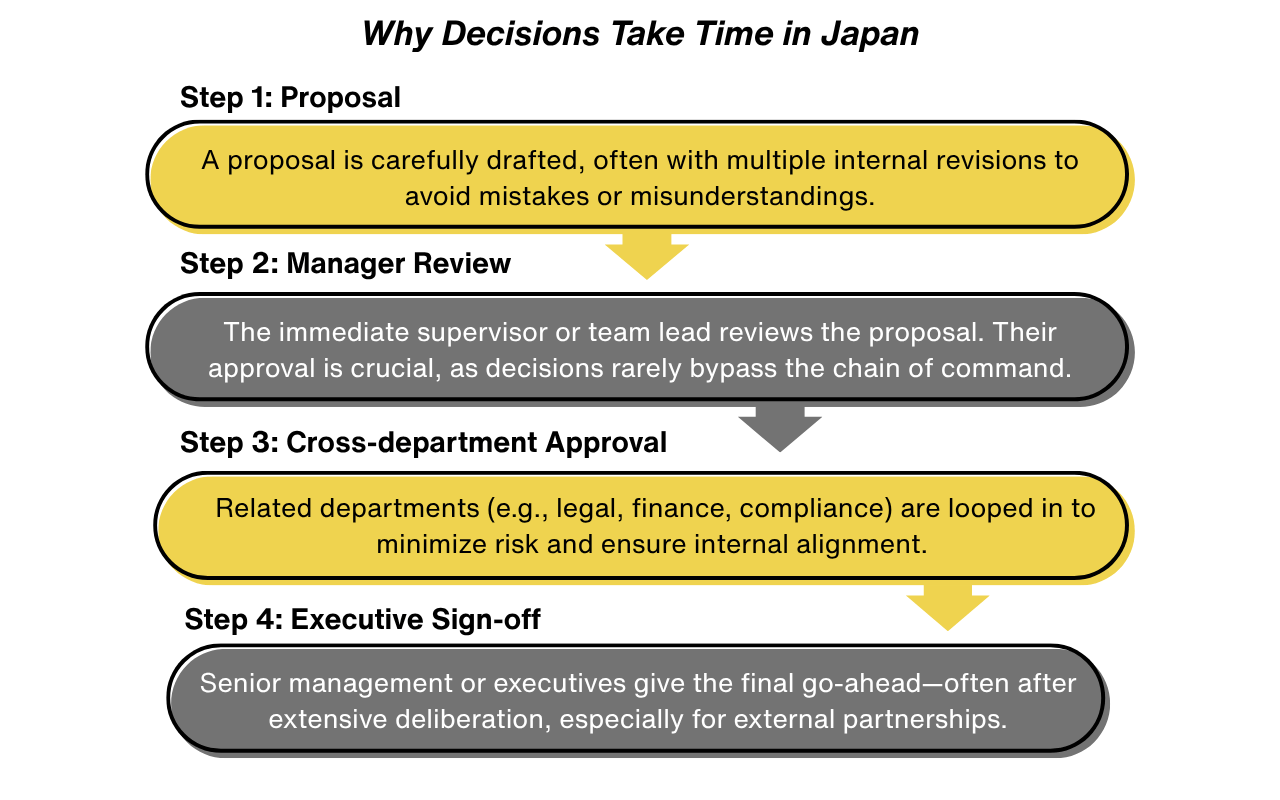

Many of my clients are surprised and sometimes frustrated by the slow pace of decision-making in Japan. I understand that. It’s not always fun to wait.

However, there are techniques to navigate this process. What matters most is understanding why decisions take time and how to mitigate delays. This is why many of our clients and partners appreciate our professional support.

Japan’s exceptionally high quality standards

Another important point is the high expectations for quality. Flawless execution in business deals is expected. It’s not something you can use as a differentiator in Japan.

Personally, I believe this is closely tied to the fact that things take time. It’s like two sides of the same coin: Japanese companies take extra time because they want to ensure top quality.

No one wants a cheap, rushed job. This often results in multi-layered approval processes: one person approves, then another needs to approve. While I don’t necessarily think this is always efficient, it reflects the priority placed on precision and trust.

On the positive side, Japanese businesses highly value trust and long-term relationships. Once they are satisfied with your product or service, they tend to stay loyal for years. The same applies to partnerships between companies. It may take time to build trust, but once established, the connection is strong. In that sense, the Japanese market is an excellent place if your goal is to build sustainable, long-term success.

3. Choosing the right Japan market entry model

Now, let’s move on to the strategy aspect of entering the Japanese market. Remember when I talked about the importance of long-term relationships and trust?

That’s the first key point I want to highlight. Instead of feeling stuck because of this, use it as a strength to kickstart your entry. This means choosing your partners carefully.

Partnership-driven model

Good or bad, partnerships in Japan tend to last a long time. So it’s critical to pick the right one. I’ll show you the best approach.

Japanese Market Entry Models

| Model | Speed | Cost | Control | Trust Needed |

| Local Entity | Low | High | Full | Medium |

| Distributor | Medium | Medium | Low | Medium |

| Partner Agency | High | Medium | Medium | High |

A partner can take many forms. For example:

- A distributor if you’re selling tangible products

- A marketing or market-entry partner (like our agency Kotoli), that helps you navigate cultural and strategic aspects

We specialize in identifying and helping you build strong partnerships in Japan. Think of it like a growing tree: you are the trunk, and your success depends on the roots and branches you develop through trusted partnerships in Japan.

As I mentioned before, Japanese businesses tend to be conservative, and few professionals are fluent in English. Combined, this creates a challenge for foreign companies.

If you don’t speak Japanese and have no local references, it becomes hard for them to trust your business because they lack a proper way to evaluate the partnership.

So let me make this clear: to start strong, find a trusted partner in Japan. If you need guidance, we’re happy to help point you in the right direction.

Maintain ownership and collaborate with partners

There are several other Japan market entry models, such as franchising and licensing. Both, however, require partnerships with local players.

And their success heavily depends on the quality of those partnerships. Personally, I recommend an alternative that gives you better ownership: maintain your brand under your company while working with an agency to handle cultural differences and Japan-specific marketing strategies. This approach lets you keep full ownership of your brand while ensuring everything necessary for growth in Japan is handled correctly.

As an added benefit, our agency also provides constructive and actionable feedback on efficient business operations that can help you scale in other countries as well.

Big or small, start online first

There’s also the option of heavy investment, such as building a local plant or incorporating a Japanese entity. These are solid choices in terms of potential return, as they allow full control over business operations and brand direction.

However, this approach requires more capital (and ideally a higher risk tolerance, because failure would result in significant losses). It also demands hiring trusted employees who understand Japan’s business culture and your specific industry. This should be approached as a long-term process.

Even if you choose this route, I strongly recommend starting with a gradual expansion through online sales. Whether you sell products or services, it’s often possible to begin selling online. This approach allows you to gauge demand with real-world experiments instead of getting stuck in endless research. Research is important, but small-scale testing is crucial for making progress.

I’d be happy to assist you in designing a practical solution for this approach. Starting with online sales is one of the smartest ways to test your product or service in Japan before committing to a full-scale expansion.

4. Understanding Japanese business culture

Now, we can’t avoid discussing this critical aspect: culture. I’ll focus on the elements that directly impact your success.

This isn’t just “nice to know” information: when doing business in Japan or working with local companies, cultural awareness is essential. A lack of understanding can seriously harm your brand image, weaken your business presence, and ultimately affect your bottom line.

Cultural understanding = strategic advantage

Think of cultural knowledge as a strategic advantage, not just an extra. At Kotoli, we always emphasize embedding cultural awareness into every business activity in Japan. For example, when writing emails, you should address business partners and customers by their last name.

Using their first name sounds overly casual, as if you’re speaking to a close friend. While being friendly might align with your brand values elsewhere, in Japan, this level of informality is often seen as disrespectful rather than approachable. Avoiding these common mistakes is an easy win that prevents unnecessary setbacks.

Japanese Business Communication Dos and Don’ts

| Situation | Don’t | Do |

| Emails | Use first names | Use last names + sama |

| Feedback | Be direct | Be subtle/respectful |

| Meetings | Rush decisions | Expect slower pacing |

Avoid typical mistakes (including AI misuse)

This brings me to the small details that matter. In Japan, small mistakes can lead to big losses. Take meetings, for example. In many Western cultures, it’s common to express your opinion clearly with a “yes” or “no.” In Japan, that’s not always the case.

People often use subtle expressions to avoid direct confrontation, even in business. A blunt “no” can feel hostile or create tension, which Japanese society tends to avoid at all costs. Understanding this nuanced communication style is key.

There’s much more to learn, but by now, you can probably see why using an AI tool to translate English emails into Japanese is not a safe approach. If you’re serious about doing business in Japan, having someone you can trust to handle communication is essential.

As I mentioned at the beginning of this article, these complexities make it challenging for many businesses to enter the market. But the good news is, once you overcome these barriers, you’ll be in a much stronger position to offer your products and services to Japanese businesses and consumers.

5. Marketing and localization strategy

Now, my favorite part: localization and marketing. Localization doesn’t deliver its full impact without marketing, and marketing doesn’t make sense without proper localization. To give you some context, localization goes beyond simple translation.

While the terms “translation” and “localization” are often used interchangeably, I’m not here to nitpick definitions. Just understand this: localization involves strategic considerations to ensure your message resonates effectively with Japanese businesses and consumers.

Translation vs. Localization

| Feature | Translation | Localization |

| Focus | Language | Strategy + Culture |

| Goal | Understanding | Conversion |

| Audience Fit | Low | High |

Great localization pays off

You might be wondering if you really need localization and marketing at all.

Let me give you a clear answer: yes, you do. Not just any translation, but professional work.

There are plenty of translators out there, but who you work with makes a massive difference. Let me stress this based on what I’ve seen: many failed businesses (who later came to me for help) made their first mistake with poor translation.

Here’s an analogy: imagine you’re hiring a salesperson for a high-end car brand. Your customers are car enthusiasts who appreciate quality.

Would you hire a kid who knows nothing about cars but likes popsicles, or an experienced salesperson in the auto industry? Obviously, the latter.

Why? Because expertise matters. Now think about translation.

Are you hiring just “any Japanese speaker”? Or someone who understands marketing, your business goals, brand voice, and strategy? That’s what separates poor translation from strategic localization.

Localization + marketing = higher ROI

Localization goes hand in hand with marketing. It’s not an afterthought; it’s part of your business strategy. So, seriously consider how you incorporate localization into your Japan market entry plan. It’s a crucial piece of the puzzle. The key takeaway: don’t just hire a translator.

Instead, ask:

- Do they specialize in your industry?

- Do they understand your product or service?

- Can they align the language with your branding and marketing goals?

Also, let’s talk about SEO. If you’re producing regular blog posts for organic traffic, proper SEO keyword research is essential. You need to understand your potential customers, their needs, and the exact terms they use in Japanese. This requires research and experience in the field. Again, ask your localization partner if this expertise is included. Translating content isn’t just about words. It’s part of your broader business strategy.

What about ads? Google Ads, for example, is a great way to attract new leads and customers. We use it often for our clients. Running ads effectively in Japan requires native-level knowledge.

Machine-translating English keywords into Japanese doesn’t work. I’ve seen many clients try this, and the results are usually disappointing: no matching search volume, irrelevant clicks, or worse, spending money on the wrong audience because of poor keyword targeting.

And while we’re on the topic of marketing, here’s another tip: produce content that builds trust. Trust is something we’ve already talked about, and in Japan, it matters even more than in many other markets.

One powerful way to build trust is to showcase your business presence in Japan. For example, create content featuring your Japanese partners or customers to show that you’re legitimately active in the market. This signals credibility and reassures potential clients that you’re not just “testing the waters” from abroad.

6. Cost and resource planning

Not everyone likes to think about it, but we can’t succeed without considering expenses. At this early stage, it’s essential to factor in costs and resources.

Money and people – how much do you know about them?

I recommend starting with an analysis. Begin by reviewing the resources you already have. Resources typically include two main elements: money and people.

As a localization and marketing specialist, I would also add tools to this list. Do you have the right tools at hand? Tools are valuable for fixing issues, streamlining processes, and increasing profitability. However, I recommend treating them as costs rather than assets, because tools alone don’t create results.

You need people to use the tools effectively.

Tools need humans

Think about it: having HubSpot, SEMrush, or Rank Math doesn’t change anything by itself. You need someone who knows how to leverage these tools to achieve results. So, when considering tools, always factor in:

- The cost of the tool

- The results it can realistically bring

- The people (or time) needed to make the most of it

This mindset is especially important when deciding whether to adopt new tools. If you don’t have professionals who can use them, don’t buy them. Remember, training takes time away from their existing tasks, so factor in that downtime as well.

Start by listing your resources and costs:

- How much money do you have?

- What’s your budget for Japan market entry?

- How many people can you allocate?

And don’t think of this as a one-time payment. It’s a continuous investment. Ask yourself: what’s your budget for ongoing Japan market entry and growth activities?

Obviously, you shouldn’t spend more than you can afford (unless you’re willing to take on loans and risk). But always think in terms of ROI (Return on Investment). After defining how much you can spend, keep an eye on how much return you get for every dollar (or Japanese yen). To do that, you need business analytics.

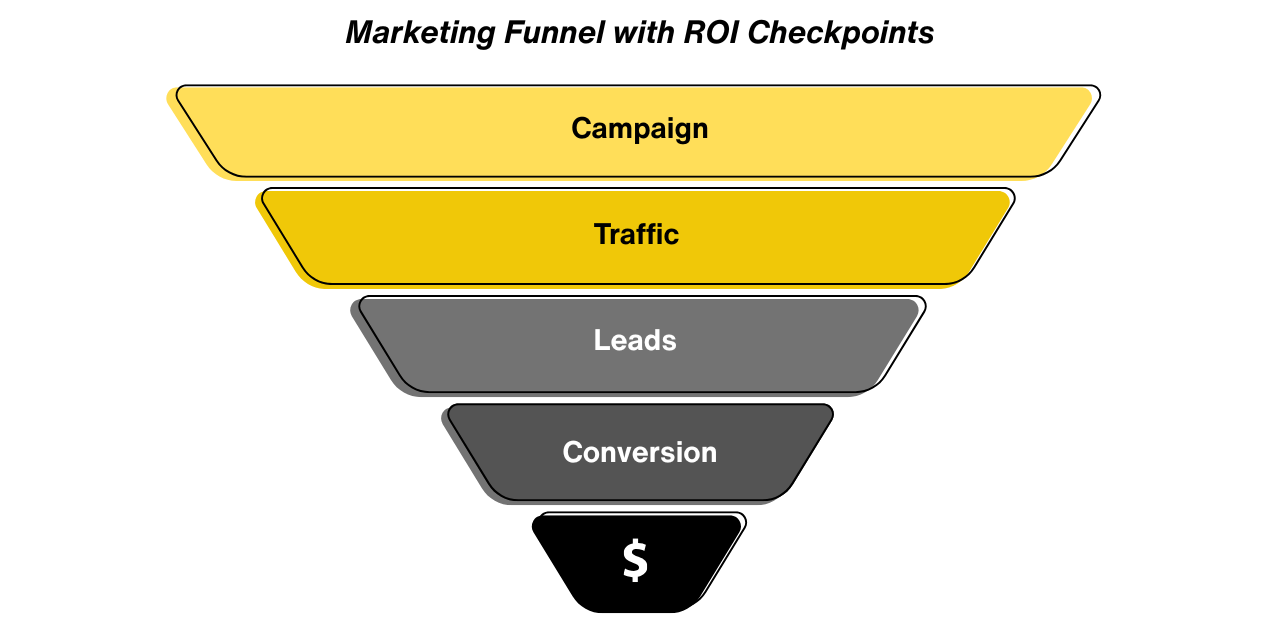

Start at the bottom layer: revenue. Did your marketing campaign increase profits? Often, you won’t see an immediate or direct connection. That’s okay.

If not, go up the funnel: did the campaign increase website visits, signups, or leads? If not, go further. Repeat this process until you find where changes occur.

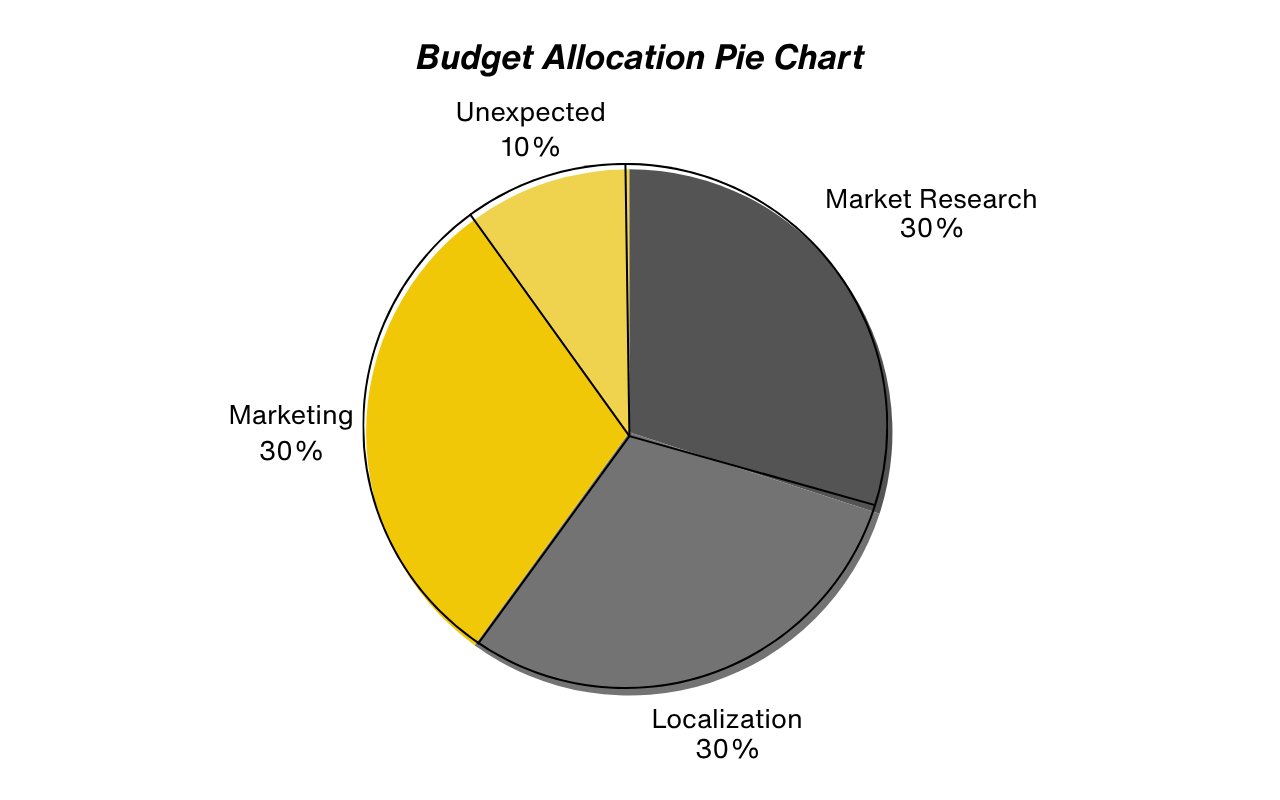

Now that we’ve covered the approach, let me share a sample budget allocation for entering the Japanese market:

- 30%: Market research

- 30%: Localization

- 30%: Marketing and tracking

- 10%: Additional expenses (flexibility for unexpected costs)

This is just an example, but here’s the key point:

- Start with cost and resource analysis

- Conduct market research to understand where you’ll compete

- Invest in localization (you can’t start testing without Japanese content)

- Focus on key content

- Choose professional localization that aligns with your brand identity, business goals, value proposition, and customer pain points

- Move on to marketing to put your product/service in front of potential customers

- Track and analyze performance

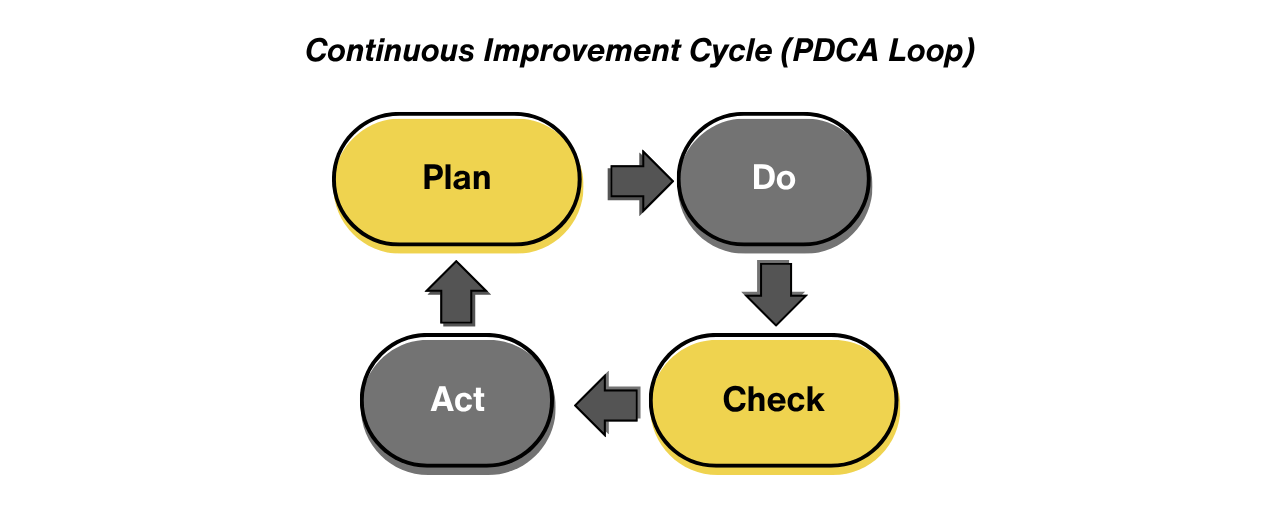

This creates the minimum viable cycle of learning. Once you have data, you can adjust and make better decisions. This requires knowledge across business analysis, market research, localization, marketing, and performance tracking. At Kotoli, we cover all these areas, so you don’t have to worry about hiring multiple professionals and managing them around the clock.

7. Scaling and long-term success

Scaling comes after Japanese market entry. This may sound like a long-term goal or strategy, but at this point, it’s worth considering. I’m not suggesting we define every step for the next 10 years. Rather, the point is to think about the potential for growth now, because you don’t want to just enter the market and get stuck. You want to grow and maximize profit.

Market scalability and operational scalability

When it comes to scaling, I recommend considering two key aspects of the business.

The first is the market. In simpler terms, the customers.

Are there a growing number of potential customers in Japan? If so, that means you have a solid opportunity to grow. You don’t want to compete in a shrinking market. Sure, you could try to make a quick profit from a declining market and exit, but personally, I prefer a long-term, future-proof strategy. That means targeting a growing market.

The second aspect is how you scale your business operations. This is more about what you have full control over, as opposed to external factors like customer volume. When I talk about scaling your business, the key question is: “How can you multiply the work you complete without increasing the time you spend on it?”

Think about a restaurant where you work as the chef. You are the only chef, and your time is limited. That means your output (the amount of food you can produce) is limited. You can increase the value of your product (your food) through experience and reputation, but you will eventually hit a ceiling because you are the only one producing it. To make the business scalable, you hire more chefs or install semi-automated machines to speed up certain processes.

This might increase costs, but as long as your revenue exceeds the investment, it’s a net positive. There’s no capacity limit if you expand by adding more employees and automation, unlike when you work alone. That is the basic concept of a scalable business.

Remove limitations and let your business scale

In the online business world, things can be even simpler. For example, a consulting service can be productized by creating a series of videos. That format is far more scalable because you remove the manpower limitation. In that sense, removing limitations is the key concept of making your business scalable.

When it comes to achieving long-term success in the Japanese market, it’s important to actively seek feedback on the services and products you offer. I personally feel that Japanese customers are less likely to provide feedback unless they are specifically asked, or worse, unless they have a negative experience. Combined with this tendency, once you lose the trust of Japanese customers, it can be very difficult to regain.

To avoid the common pitfall of losing trust and your customer base in the Japanese market, I recommend making feedback collection an integral part of your business strategy. As I mentioned earlier in the section on business culture, Japanese people are generally not direct in expressing their opinions. To get honest feedback, you often need to build stronger relationships over time. This applies not only to customers but also to business partners.

The good news is that once you establish a strong relationship, it tends to last for a long time and supports sustainable business growth. It’s not uncommon for one connection to lead to another deal, and that deal to open the door to the next. Once you’re on the right track of building trust, long-term success becomes much more likely.

Continuous improvement

Also, don’t forget the importance of continuously improving operations. This means you need to enhance your product and service to increase the value delivered to your customers.

A key aspect here is the perceived value. The value is not always absolute but relative.

Your business will always be compared to other options and competitors (more about identifying competitors here), so you need to consistently make efforts to be better. That mindset should be shared across the entire organization. Localization is part of this effort, and once you start localizing, you must maintain high quality, as it becomes the primary language you use to communicate your business to customers in Japan.

Conclusion

In this article, we covered the key aspects you need to know before entering the Japanese market. My experience is primarily with online businesses, so many of the examples I gave relate to that space. However, the concepts I outlined apply to almost any type of business.

To recap, Japan is a great country and a promising market with plenty of potential for business growth. At the same time, you may encounter surprises as you start working with Japanese businesses and consumers.

But don’t worry. Armed with the right knowledge, you can avoid common pitfalls. You might experience unexpected moments or even a bit of culture shock along the way, but don’t let that stop you. Instead, treat those moments as opportunities to take your business further. They are part of the process. Every time you face and overcome these challenges, you’ll grow stronger as a business professional.

Some conservative aspects of the market may seem off-putting at first, but I personally appreciate the long-term, trust-based culture in Japan. Once you build strong relationships with local partners, you can rely on them and grow together.

You won’t need to constantly worry about being betrayed. This stability allows you to focus on business growth with a sense of harmony (known as wa in Japanese). It’s a great feeling. You’ll understand once you experience it.

You may still have questions, and that’s perfectly natural. Learning always leads to new questions. We’re here to guide you in the right direction. From planning and market research to localization and marketing strategies tailored for long-term growth aligned with Japanese business culture. We are the experts. Let us know what you’d like to achieve or discuss. Contact us now, and I’d be happy to go over the details with you.

Founder of Kotoli, an agency specializing in helping international businesses enter and succeed in the Japanese market, from higher-level strategic positioning, business management, and market fit, to more tactical marketing implementations such as ads, SEO, content marketing, and localization.